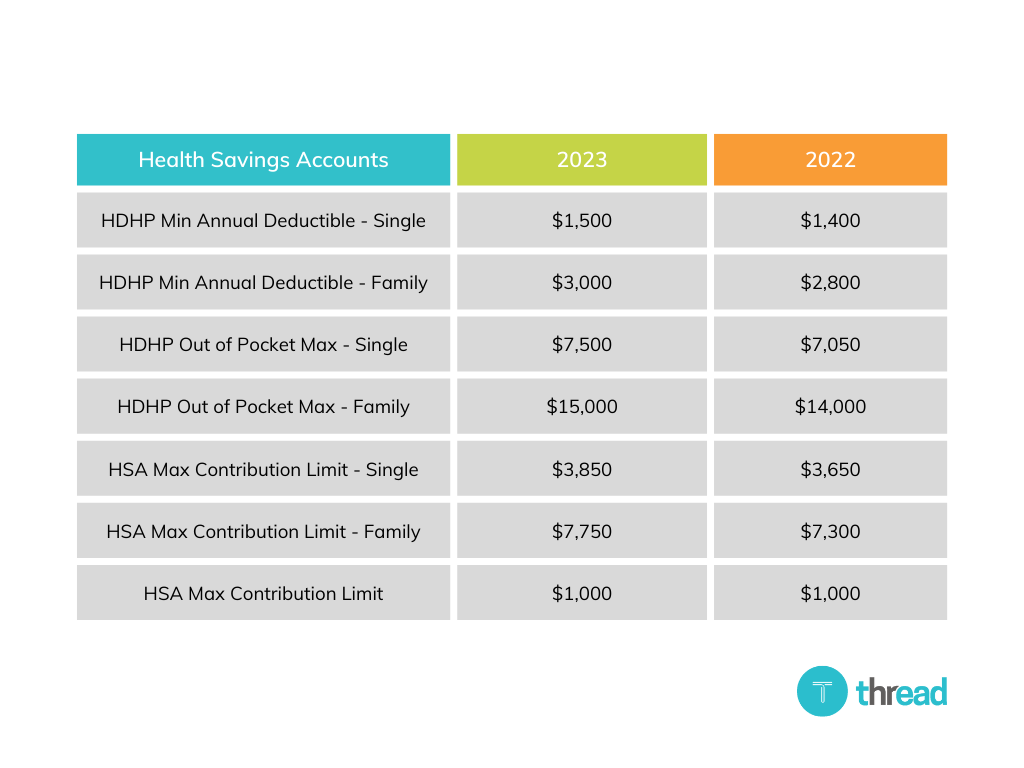

2025 Fsa Contribution Limits Family 2025. How do fsa contribution and rollover limits work? An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

An fsa contribution limit is the maximum amount you can set. Fsa contribution limits for 2025 family.

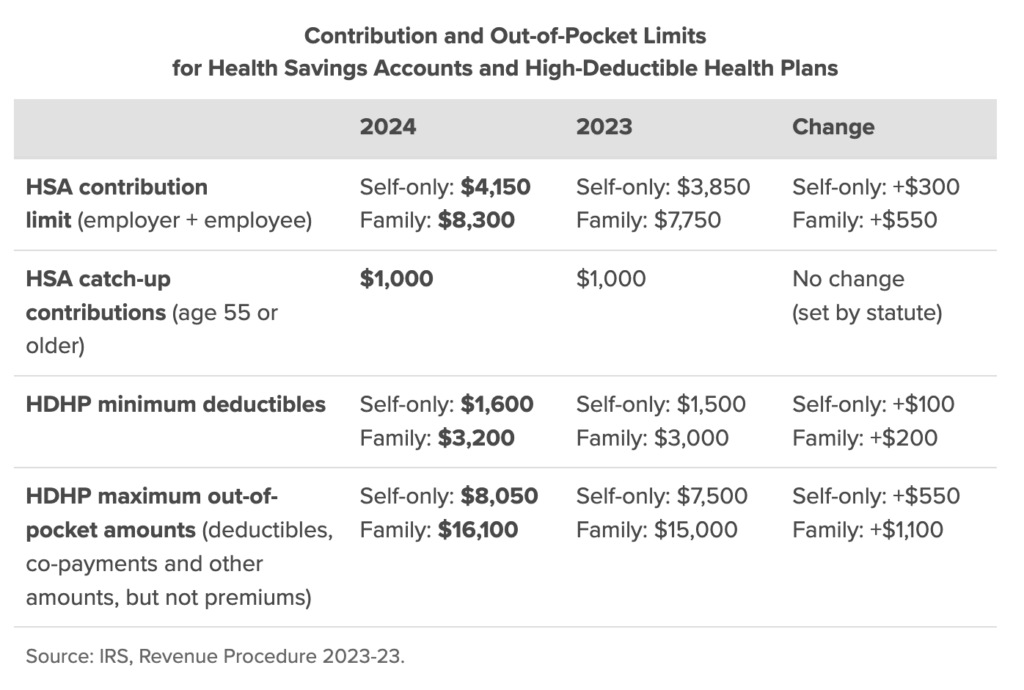

2025 Fsa Contribution Limits Jess Romola, These limits will go up to $4,300 for single coverage and $8,550 for family coverage in 2025.

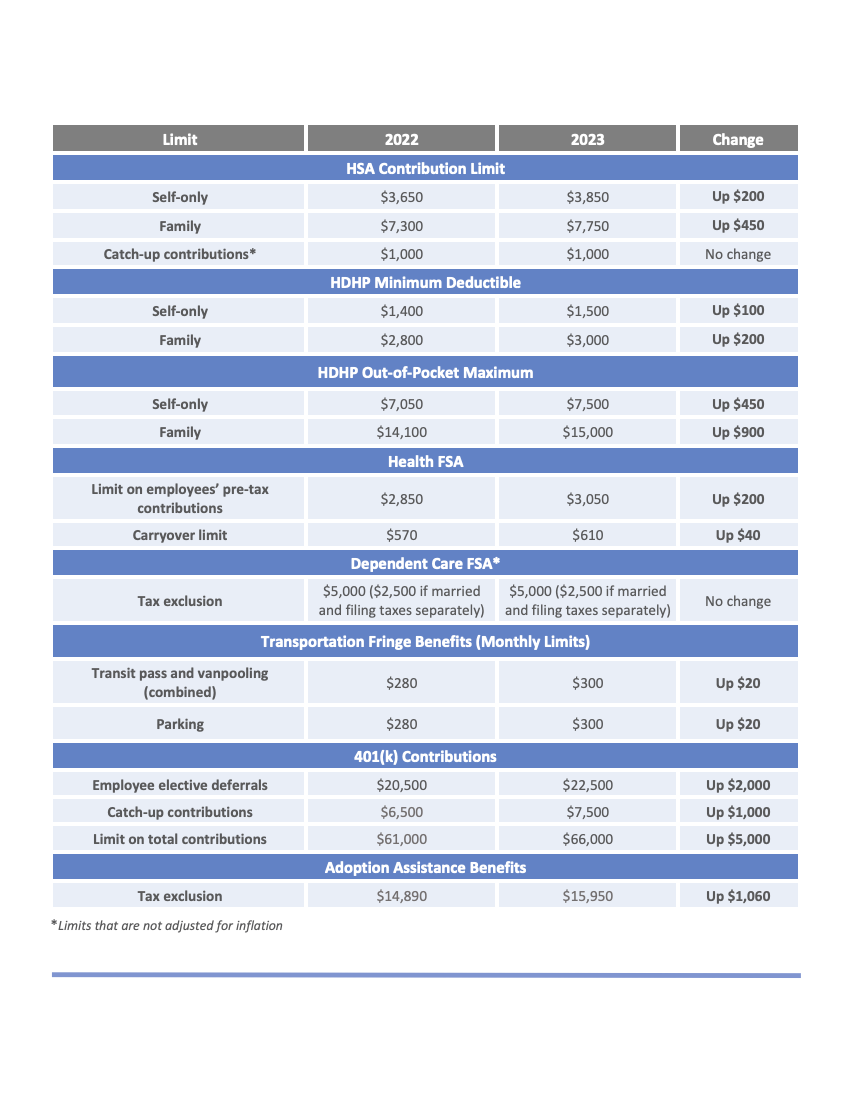

Fsa Contribution Limits 2025 Family Leave Naomi Kirsteni, For 2025, there is a $150 increase to the contribution limit for these accounts.

Annual Dependent Care Fsa Limit 2025 Married Lacey Aundrea, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

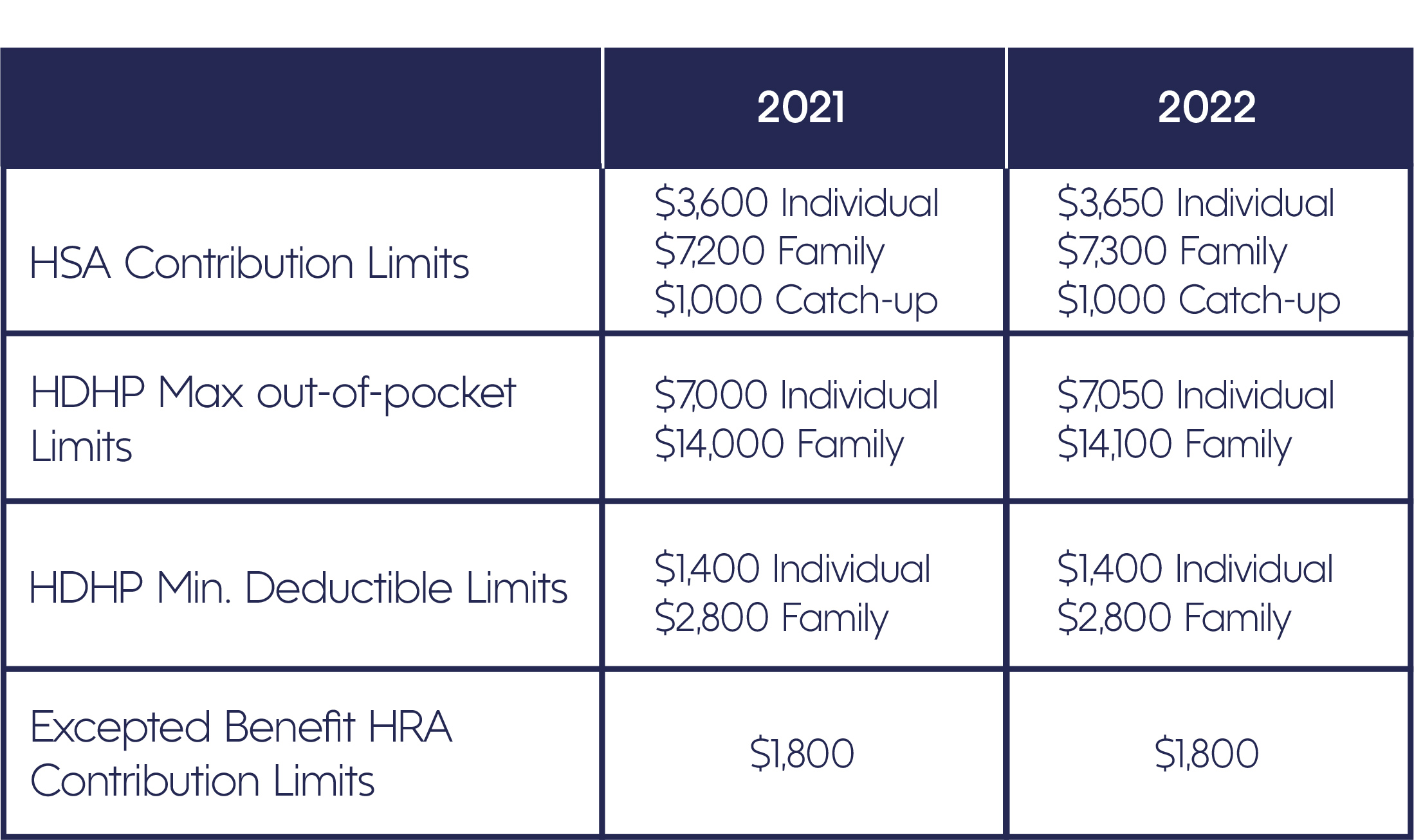

Maximum Fsa Contribution 2025 Family Sybil Euphemia, How do fsa contribution and rollover limits work?

Dependent Care Fsa Limit 2025 Over 50 Naoma Loralyn, Keep reading for the updated limits in each category.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, The irs announced the hsa contribution limits for 2025.

Fsa Employer Contribution Max 2025 Calendar Joete Madelin, Each employee may only elect up to $3,200 in salary reductions in 2025, regardless of whether he or she has family members who benefit from the funds in that.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

401k Max 2025 Catch Update Candy Jeralee, An fsa contribution limit is the maximum amount you can set.

Fsa 2025 Limits Irs Bunny Meagan, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).